Unlike other LLC formation companies, you create an annual subscription account with ZenBusiness that starts at $39 per year. This model allows ZenBusiness to offer lower rates to form an LLC than other companies while providing ongoing support overtime. Most other LLC formation companies send you the documents in the mail and don’t provide much support (if any) beyond the initial filing process.

If you like the option of ongoing support paired with a low-cost to file an LLC, ZenBusiness is a quality option. In this review, I share the pricing strategy, pros and cons, summary of customer reviews, and walk you through the filing process with ZenBusiness so you know what to expect.

So far, ZenBusiness holds the to overall score for LLC service based on all the reviews I’ve completed so far. Read my full review below. Click here to register your LLC with ZenBusiness for only $39 + State Fees.

Evaluation Criteria:

- Price: 10 out of 10

- Customer Support and Refund Policy: 8 out of 10

- Customer Reviews and Reputation: 9 out of 10

- Ease of Use: 10 out of 10

- Total Score: 37 out of 40

Page Contents

- Advantages of ZenBusiness

- Disadvantages of ZenBusiness

- How Much Does It Cost to File an LLC With Fees?

- Total Score: 37 out of 40 (My Top Overall Review)

- Customer Support and Refund Policy: 9 out of 10

- Customer Reviews and Reputation: 8 out of 10

- Ease of Use and Experience: 10 out of 10

- ZenBusiness Alternative Services

- Frequently Asked Questions

- Is ZenBusiness legit?

- Do you need an LLC?

- How to contact ZenBusiness customer support?

- Is my information shared with third parties?

- Can you form an LLC outside the United States?

- Is there a refund policy?

- What upsells are there with this service?

- Is ZenBusiness a registered agent?

- How long will it take to process an LLC formation?

- How are you taxed with an LLC?

Advantages of ZenBusiness

- Affordability is the main selling point for this six-year-old business formation company. The starter package is just $39 plus the state registration fee. That’s the lowest cost of any LLC service company I’ve reviewed.

- New customers of ZenBusiness only need to spend a few minutes completing forms with information about their business. The website then prompts them to select a package and provides in-depth details about each one.

- Once customers have completed the required paperwork and paid the fee, ZenBusiness handles ongoing maintenance such as filing an annual report with the state. This is resolves what can become an administrative hassle in the future.

Unlike other business formation companies that base their turnaround time on how quickly the state processes applications, ZenBusiness is transparent with how long customers can expect to wait. I really appreciate this approach.

As background if you’ve never filed for an LLC before, you need to wait for the local state government you’re filing the LLC to review and approve the submissions. All LLC formation services must wait for this, but a lot of alternative companies don’t mention it clearly.

The company’s guidelines are as follows for LLC turnaround time:

- Starter package, three to four weeks

- Pro package, one to two weeks

- Premium package, three to five days

Disadvantages of ZenBusiness

ZenBusiness does not offer the option to file as a non-profit organization so people seeking that status will need to look elsewhere. As an alternative, the company IncFile offers LLC formation for non-profit organizations.

How Much Does It Cost to File an LLC With Fees?

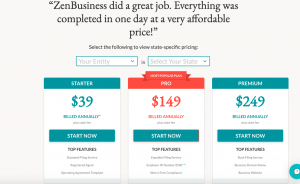

Before choosing a plan for their company, business owners should select their entity type and state at the top of the registration page on the ZenBusiness website to see state-specific pricing. ZenBusiness offers the three business formation plans described below.

Starter: Billed annually at $39, the top features of the ZenBusiness Starter Plan include:

- 100% accuracy guarantee

- Email and phone support

- Free accounting consultation

- Google Ads credit

- LLC preparation and filing according to state requirements where the new business is located

- Name availability search to ensure the business name the customer wants is available and not already claimed by another entity

- Online document access

- Operating agreement template

- Registered agent annual service is free for the first year and billed at $119 annually after that. A registered agent receives and reviews documentation from the state on behalf of a business. ZenBusiness reviews the documents for the customer and then forwards them.

- Virtual business guide

Business owners who purchase the starter package have the option to add up to seven additional services included in the other packages for an annual cost ranging from $30 to $119. I cover the specific options available during the checkout process later in the review.

Pro: ZenBusiness advertises the Pro Plan as its most popular package. The Pro Plan is $149 per year and includes everything listed in the Starter Plan plus these features:

- Banking resolution template states the names and positions of people within the company who have the authority to open a bank account on behalf of the business.

- Employer ID number is a nine-digit number similar to a social security number that enables businesses to hire employees, open financial accounts, and file tax returns.

- Worry-free compliance covers the annual filing requirement and two addendums. ZenBusiness will assist business owners who miss state filing deadlines to regain their good standing.

Pro Plan members can opt to purchase a business website or upgrade to rush filing speed for $100. They can also select a business domain name for an additional $25 fee.

Premium: The most feature-rich business formation plan starts at $249 per year. Premium Plan members receive everything listed for the Starter Plan and Pro Plan along with these extra benefits:

- Business domain name registration

- Business email address with up to 5 gigabytes of storage space

- Business website set-up assistance

- Domain name privacy service keeps personal details about the business owner from going public.

The prices quoted for all three plans do not include filing fees that vary by state. This is typical because the state filing fees differ from state to state.

I gave ZenBusiness a 10 out of 10 on price. Not only is the total cost extremely affordable for almost anyone at $39 per year, but you get a lot of extras that alternative services leave out like operating agreement templates and a free registered agent service for the first year.

Finally, ZenBusiness doesn’t sneak in hidden fees and charges at the end of the checkout process like so many of the other services. Other companies may offer a lower upfront fee, but when it comes time to check out the total cost ends up being a lot more.

Total Score: 37 out of 40 (My Top Overall Review)

ZenBusiness is affordable and offers a comprehensive list of services without a lot of added pressure to purchase upsells. Customers at all three service levels receive free registered agent service for the first year, providing them with valuable peace of mind that you will be this important requirement for running an LLC.

With 95% of its customers choosing a four or five-star rating, ZenBusiness clearly prioritizes customer service. Customers cannot receive a company seal or start a non-profit through ZenBusiness. All things considered, we give ZenBusiness a 9 out of 10 rating. Other lower cost, LLC formation companies I’ve reviewed don’t get these high marks on customer service.

Customer Support and Refund Policy: 9 out of 10

Although ZenBusiness bills its plans at an annual rate, customers are free to cancel them for a pro-rated refund at any time. ZenBusiness will process the refund within a few days of receiving the customer’s cancellation request.

Considering the low-annual cost of this service ($39 per year for the start plan), you won’t be out much money if you decide to cancel and ask for a pro-rated refund. I didn’t find any other LLC formation company that offers any refund policy beyond 90 days of filing an LLC.

The toll-free telephone number to reach ZenBusiness customer support is 1-844-493-6249. Representatives are available Monday to Friday from 8:00 a.m. to 8:00 p.m. and Sunday from 10:00 a.m. to 7:00 p.m. Central Standard Time (CST). When I called ZenBusiness, expect to be put on hold for awhile. I waited 22 minutes to get on the line with a representative when contacting the company through this number. Wait times are par for the course when contacting customer service at any company so I don’t view this as a negative, but is worth noting for this review.

Customers can choose to chat with a representative in real time by clicking the Chat Now button on the ZenBusiness website. Live chat is available Monday to Friday from 8:00 a.m. to 8:00 p.m. and Sunday from 10:00 a.m. to 7:00 p.m. CST. The email to reach customer support is [email protected]. The company states that customers can expect a reply within one business day.

Customer Reviews and Reputation: 8 out of 10

ZenBusiness has overwhelmingly favorable reviews on the top review sites. I provide examples of recent positive and negative reviews from the Better Business Bureau (BBB), Google Business, and Trustpilot below.

BBB: ZenBusiness has an A- rating and received BBB accreditation in December 2019. The company has an overall star rating of 3.18 of 5.00 based on 28 customer reviews, and the BBB has investigated and closed 20 complaints against it in the last 12 months. The most recent positive BBB review, dated April 23, 2021, states:

Jenna is absolutely AWESOME! Very patient & knowledgeable of the product I had questions on and answered all to my satisfaction! Customer service is excellent!!

Several reviewers prior to this one discussed how helpful and knowledgeable this particular customer service agent was with answering their questions and helping them start the business formation process.

All gave five stars. The most recent one-star review posted on March 4, 2021, stated that the customer waited six weeks to receive LLC formation paperwork back only to find out ZenBusiness had to re-submit it to the state. The company took ownership of the issue and offered to work with the customer.

Google Business: Thirty people have reviewed ZenBusiness so far on Google Business. Of those, 24 have rated the company at four or five stars and six have chosen one to three-star ratings. The most common feedback among positive reviewers was how simple the service is to use. Those who chose neutral or negative ratings had difficulty with delayed paperwork or reaching customer support, but the company reached out and resolved their issues.

Trustpilot: As of April 2021, the company had 5,847 reviews on Trustpilot with 86 percent of reviewers selecting a five-star rating. The overall rating is 4.8 out of 5.0 stars, putting ZenBusiness into the excellent category. Several of the most recent reviewers discussed the ease of working with ZenBusiness compared to other business formation companies they considered using or had used in the past. The most recent five-star review posted on April 19, 2021, and stated the following:

This was my first time trying to branch off into a business. After weeks of searching reviews and what other companies offered, I settled on ZenBusiness and couldn’t be happier. They took care of everything and getting my Body Drip LLC was so much easier than I thought. They offered everything I was looking for in an affordable package. I definitely recommend them if you’re looking to start a business or need worry-free compliance!

A recent one-star review for ZenBusiness was posted on April 19, 2021. The customer complained of not receiving the employer identification number for a week after ordering rush service. ZenBusiness responded right away outlining the timeline and offering further assistance to the customer, although they appeared not to be in the wrong.

I suggest filing your LLC sooner than later so that you aren’t under pressure to get the documents immediately and in case of delays. Many of the negative reviews are from customers who had only a few days to get legal documents created.

Ease of Use and Experience: 10 out of 10

Here’s what the step-by-step process looks like to from an LLC with Zen Business. I also note the upsells and optional field along the way so you know what to expect. To begin the filing process, click the “Start Now” button as shown below.

ZenBusiness Review.

On the next page of the form, you’ll specify your business entity (LLC or Corporation), select the state you would like the file the LLC, and the package. I decided to go with the Pro plan billed annually at $149.

ZenBusiness Plans.

Next, the LLC formation wizard cutely named Rovie, will ask for your first name, middle name, last name, and suffix. Click the “next” button when you’re ready to proceed.

Account creation process.

Enter your email and phone number on the next page of the form. Click “Next” when you’re ready.

Enter contact information.

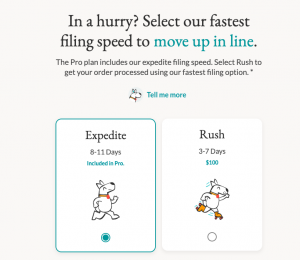

If you’re in a hurry to get your LLC documents in hand, you may select rush delivery for an additional $100 charge. This will get your LLC documents processed in 3 – 7 days. As part of the Pro plan I selected, I can expect processing to take 8 – 11 days.

Expedited filing.

Secure your business domain name for $25 per year. While I believe in claiming a business URL is a good idea, I prefer registering through other websites. I responded “no” to this question.

Register domain.

Choose to create a customizable website for $50 per year. Personally, I would not use this service unless your website needs are minimal because the sales page isn’t clear on what you get with it. I.e. If you only plan on using the website to host telephone, address information, and don’t plan to actively market yourself online then it should be fine.

I am also comfortable with the mechanics of operating a website so I wouldn’t want to lock myself into a platform like this. If you run a more tech oriented company like a design or marketing company, e-commerce company, or a blogger you’ll certainly want to steer clear of the service.

website offer

After that, enter the name of your business. Don’t worry about adding the LLC or L.L.C. to the name. ZenBusiness will handle that part later.

Name the business.

Review the information you’ve submitted. Make sure the fields for business entity, state, and account information is correct. Note: You add members / managers after the checkout process with this service. Click “next” when you’re ready to move ahead.

Let’s confirm your information.

In the next section of the form ZenBusiness will give you an estimated date when they expect your business to be officially formed. On this page, you’ll also review the order one last time and view the projected charge including the filing fee for your state. Keep in mind that the state fee goes directly to the state government where you form the business, not ZenBusiness.

Let’s finish up.

You’re almost done. Enter your debit or credit card information to complete payment on this page. You’ll also a password for your ZenBusiness account and agree to the terms and conditions of the website. Click the pay button and you’re done with the process.

Enter payment details and create an account password.

Overall the process of forming an LLC with ZenBusiness is straightforward. Like other formation services there are a few upsells along the way, but they are clear on what you for the fee (domain name, website builder). Alternative services will refer you to banks, accounting firms, or offer you upsells for legal templates you probably won’t ever use.

One thing to keep in mind with ZenBusiness is that you’re creating an on-going subscription that is charged each year. This ongoing subscription model helps keep the upfront cost of using ZenBusiness compared to alternative services. I prefer this subscription model as I can view documentation in my online account and turn to the account area for support.

Other services send you the LLC documents in the mail and you’re left on your own from there. I prefer having access to an online account where I can make changes and ask questions if needed.

ZenBusiness Alternative Services

Several companies offer services similar to ZenBusiness. We highlight three of them below.

Harvard Business Services: Both ZenBusiness and Harvard Business Services offer three plan options, but their prices are significantly different. Harvard offers a Green Plan at $179, a Basic Plan at $229, and a Standard Plan at $329. The BBB rates Harvard at an A+. Each company offers registered agent service and efficient processing of business formation forms. I gave Harvard Business Services 34 out of 40 in the previous review.

Rocket Lawyer: Rocket Lawyer offers only one business formation package starting at $99.99 per year. This company opened in 2008 and has served 20 million customers, but not all are business clients since Rocket Lawyer also offers legal will service. Rocket Lawyer is slightly faster with formation speeds and both offer live customer support 12 hours per day during the week. Time in business, number of customers served, and number of positive reviews lean in Rocket Lawyer’s favor but ZenBusiness is on par with the last two categories considering it has been in business seven fewer years. I gave Rocket Lawyer a 33 out of 40.

Swyft Filings: This company offers three business formation plans with prices comparable to ZenBusiness. The Basic Package is $49, the Standard Package is $149, and the Premium Package is $299 per year, not including state filing fees. Swyft Filings has more than 20,000 online reviews with most of them positive. One advantage Swyft Filings has over ZenBusiness is that it can help people establish a 501(c)(3) non-profit organization. Swyft Filings got a solid 30 out of 40 score in our review.

Frequently Asked Questions

We provide answers to the 10 most frequently asked questions about ZenBusiness below.

Is ZenBusiness legit?

Yes. ZenBusiness incorporated in Texas in 2015 and received Better Business Bureau accreditation in 2019. The company has a 4.8 out of 5.0 star rating from over 5,000 customers. Ease of use is the biggest factor that customers appreciate and that makes ZenBusiness stand out from the competition.

ZenBusiness is an organization based in Austin, Texas offering new business owners the opportunity to register their company as a C-corporation, S-corporation, general partnership, sole proprietorship, or a limited liability company. The company, which started in 2015, offers three plans according to business needs. ZenBusiness has helped thousands of businesses get up and running in its short history and aims to service one million customers in the next five years.

Do you need an LLC?

The LLC is one of several business structures new business owners can choose. It is a good option for smaller companies when business partners want to protect their personal assets from debt incurred by the company.

How to contact ZenBusiness customer support?

Customers may call 1-844-493-6249 during regular business hours posted in the customer support section. They may also use the live chat option or email the company at [email protected].

Yes. Working with business partners to offer additional services is one way that organizations like ZenBusiness earn additional revenue. For example, Premium Plan members receive a business website and domain registration offered by third-party organizations. Customers can choose the Starter Package or click “no” when asked if they want to view more offers to avoid any upsells.

Can you form an LLC outside the United States?

Yes. People do not need to live or operate a business in the United States to form an LLC.

Is there a refund policy?

Customers have no obligation to continue their plan for one year if they change their minds about it. ZenBusiness will refund the membership package based on how much of it the customer used. However, the company cannot issue refunds once it has submitted business filings to the state on the customer’s behalf. While it is possible to get a refund before the state receives and processes the documents, customers should expect to pay at least a $50 cancellation fee.

What upsells are there with this service?

Customers can purchase upsells at the Starter Plan and Pro Plan levels. Starter Plan upsells include a business domain name for $25, banking resolution template for $30, expedited filing speed and/or business website for $50, employer ID number for $70, rush filing speed for $100, and worry-free compliance for $110. Pro Plan members can purchase a business domain name for $25, a business website for $50, or rush filing speed for $100.

Is ZenBusiness a registered agent?

Yes, and all states require businesses to have a registered agent available during regular business hours who can receive legal notices.

How long will it take to process an LLC formation?

The answer to this question depends on which package the customer chose. The average turnaround time for Premium Plan members is three to five business days. Pro Plan members can expect processing to take five to 10 business days while Starter Plan members will need to wait 15 to 20 business days.

How are you taxed with an LLC?

Single-members LLCs pay taxes the same way as sole proprietorships by preparing a Schedule C to report revenue, expenses, and net income. Multi-member LLCs pay taxes by first filing Form 1065, called an information return, with the Internal Revenue Service (IRS). Each partner receives a Schedule K-1 from the IRS showing their percentage of profit or loss with the business partnership.

Members of the LLC then transfer information from Schedule K-1 to Schedule E, called supplemental income. The last step is for each LLC member to transfer this information to their own 1040 or 1040-SR tax form.

Click here to start the process of forming your LLC with Zen Business.