When food truck owners want to expand their business a common question investors will ask is, “How is your food truck is doing?” When this question comes up you need to be able to have an answer that is ready and documented. The best way to answer this question will be done with your food truck balance sheet.

Understanding Food Truck Balance Sheet Basics

What Is A Food Truck Balance Sheet?

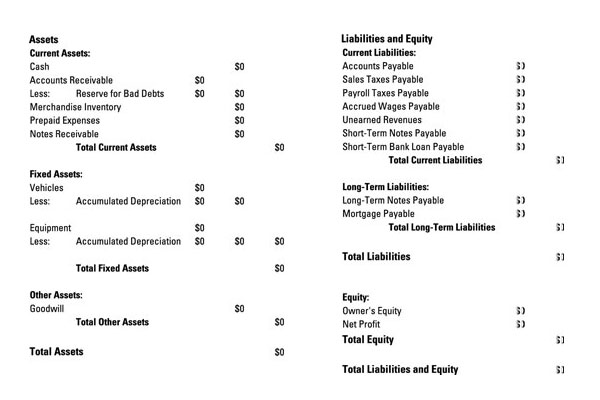

Your food truck balance sheet is a snapshot of your mobile food business’ financial position on any given day. It is usually calculated at the end of the quarter or year. A food truck balance sheet is a summary of your company’s assets, liabilities/obligations, and the owner’s financial involvement in the business.

You will need to provide your food truck balance sheet when applying for loans or grants, submitting taxes, or seeking investors.

A balance sheet is how you can make sure that all your financial records are in check. There are essentially 3 accounting categories used to keep track of your food truck finances.

- Assets: Assets include cash on hand (cash & money in the bank), accounts receivable, reimbursable expenses, inventory, and any equipment that is of value (think about your food truck and the equipment in it).

- Liabilities: Liabilities are the debts owed by your food truck business. An example of liability is a loan you received to start your food truck, accounts payable, credit cards payable, or taxes you still need to pay.

- Owners’s Equity: Equity is what you put in or take out of your food truck. Examples of equity would be opening investments, contributions, owner’s capital or retained earnings or Owner’s Equity = Assets – Liabilities.

Your food truck finances balance is: Assets = Liabilities + Owner’s Equity

Sample Food Truck Balance Sheet

How To Use Your Food Truck Balance Sheet

Comparing your “Current Assets” minus “Current Liabilities” on an annual basis will show you your food truck’s annual growth and expenses, which may need to be improved. Calculating “Fixed Assets” minus “Fixed Liabilities” can provide a more long-term view of the company’s value over time and its ability to pay back long-term debts or expenses built up over many years.

RELATED: How To Determine If Your Food Truck Is Making Money

The Bottom Line

There is a lot more to your food truck balance sheet, but for this article. This basic explanation is to help food truck owners who no nothing about balance sheets and want to learn a bit more about them. In future articles I’ll dive into creating your own balance sheet as well as discuss shareholder distributions, accumulated depreciation and retained earnings.

The basic concepts covered today should allow you to be able to make sense of most your own food truck balance sheet provided by your accountant.

Did we miss something on the topic of food truck balance sheet basics? Share your thoughts on social media. Facebook | Twitter