Thinking about opening an H&R Block franchise and wondering how much it might cost? I break down all the costs in this review and provide a warning about the tax preparation industry as a whole.

One thing you need to understand is H&R Block is moving into the DIY tax software industry, which will presumably impact franchise stores. Why? The number of individual filers walking into an H&R Block store will decline as people submitting simple tax returns from home. As the Baby Boomer generation continues to retire and younger workers enter the workforce, expect this to trend to gain more steam the next 5 – 10 years.

Are a lot of H&R Block franchises closing down? Why?

In 2018, H&R Block made the decision to shut down over 400 locations across the country. Low-profit margins and declining sales were cited as reasons for the closures. The fact is, individuals or families with W2 income no longer need personalized help from a tax preparer. Instead, consumers are complete and file their taxes with software.

Despite the fact that H&R Block has a history of closing sites after tax season, the recent loss of 400 outlets and significant stock losses have some financial experts on edge about the longterm prospects of the company. Read on to learn more about franchising with H&R Block or take our 7-minute franchise quiz to be matched with an opportunity based on your unique interests.

Page Contents

Financial Requirements and Fees

To open a new tax office, franchisees must pay for the necessary lease, furnishings, and equipment (variable expenses). It’s projected the total cost to open an H&R Block franchise is between $31,505 and $149,200.

Except for a refundable $2,500 security deposit, H&R Block does not charge an initial franchise fee. Here’s a look at the fees associated with starting this business.

| Type of Fee | Low | High |

| Security Deposit | $2,500 | $2,500 |

| Start-up Supplies | $500 | $500 |

| Leasehold Improvements; Construction Expenses | $0 | $50,000 |

| Equipment | $8,000 | $12,000 |

| Real Property (Projected total cost is for 3 months) | $1,400 | $30,000 |

| Opening | $500 | $1,000 |

| Signage | $1,200 | $6,500 |

| Pre-opening Salaries, Travel and Initial Training | $1,500 | $3,000 |

| Furniture and Decor Items | $15,000 | $30,000 |

| Utility Deposits | $50 | $300 |

| Insurance | $477 | $798 |

| Architect Design | $0 | $4,500 |

| Zoning Costs | $0 | $500 |

| Applicable Business Licenses, if necessary | $0 | $1,800 |

| Professional Fees | $0 | $2,500 |

| Additional Capital | $430 | $12,000 |

| Projected Total Fees | $31,557 | $157,898 |

Financial Requirements

There are territories available for new H&R Block franchises. There are also opportunities to acquire already-established franchises from existing operators. H&R Block does provide financial support in the form of a franchise equity line of credit for prospective franchisees who require such assistance. Here are some of the financial requirements required to operate this tax preparation business.

|

Requirement |

Fee |

| Liquid Capital | $2,500 |

| Net Worth | N/A |

| Total Investment | $31,557 to $157,898 |

| Franchise fee (security deposit) | $2,500 |

Unless otherwise stated, the initial franchise period last for a period of ten years, terminating on June 1 of the tenth complete tax season. There isn’t any automatic extension, although the franchisor is allowed to offer its franchisees to other entrepreneurs in the future.

Franchise Partner, Inc. (FPI), a subsidiary of the franchisor, provides H&R Block franchisees with commercial finance, subject to credit approval. The Term Loan Credit and Security Agreement and yearly Short-Term Loan Credit and Security Agreement contain a complete list of the provisions for FPI’s standard loan product.

Only the purchase of an H&R Block franchise, another tax preparation company, the buyout of a partner, and the refinancing of a U.S. mortgage are permitted uses for FPI’s term loan. You could also apply for a loan through the Small Business Administration. Prior to the start of each tax season, FPI’s short-term loan may be used to pay some of the operating expenses. Franchisees are allowed to take out loans from other lenders and are not obligated to secure financing from FPI.

Help business owners prepare their taxes.

How Much Profit Does An H&R Block Franchisees Make Per Year?

Company revenue / sales per year: H&R Block’s annual revenue for the year 2022 reached $3.463B, which is a 1.44% increase from 2021. In the 12 months ending June 30, 2022, H&R Block posted a 10.71% growth year-over-year.

Number of units: As of 2021, H&R Block has a total of 9,361 total units in the United States. This number accounts for both franchised and company-owned units.

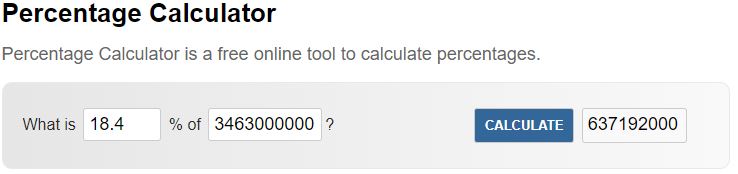

Average Gross Revenue Per Store: $3,463,000,000 (System-wide sales) ÷ 9,361 units = $369,939.11. This is a back of the napkin estimate based on publicly available data.

Industry Average Profit Margin: Understanding and being aware of your profit margins is essential for sound financial management. In order for accounting organizations to calculate profit margins, it is necessary to consider the unnoticed variables, which are frequently qualitative and intangible. Calculating your company’s ROI is the idea—you want to know if it’s actually good or not.

According to analysis, the small business sector where accounting, tax preparation, bookkeeping, and payroll services with a pre-tax net profit margin of 18.4% in 2017. Based on this estimate, you should expect to make $63,719 after expenses annually. Keep in mind you could increase profitability by working inside the business yourself.

Projected Annual Profit Per Store:

H&R Block SWOT Analysis

By carefully examining and revising a SWOT analysis, you can gain insights into the trajectory of H&R Block as a business.

Strengths

1. Strong Brand Image – In the personal services sector, H&R Block’s products enjoy great brand recognition. In comparison to its rivals in the personal services sector, this has allowed the corporation to earn more. Their customers are aware of the long-standing, well-known brand H&R Block. Consequently, it has a strong reputation among its clientele.

2. Exceptional Customer Satisfaction – The business has been successful in achieving a high level of service quality among current customers and strong brand value among potential consumers thanks to its specialized client relationship management department.

3. Talented And Experienced Workforce – The staff at H&R Block is made up of competent and certified individuals. H&R Block has made significant investments in the development of its staff, which has enabled it to hire a considerable number of motivated and skilled workers. As a result, the staff is not just highly qualified but also driven to accomplish more.

You Might Like: Should You Work with a Franchise Broker? (The Good and Bad)

4. Outstanding Results in Untapped Markets – H&R Block has developed proficiency in breaking into and succeeding in new markets. The company’s expansion has enabled it to develop new revenue streams and spread the risk of the economic cycle in the markets it serves. The development of new goods and expansion into new markets have been made possible by H&R Block’s creative teams. In the past, it has had success with the majority of its initiatives in new markets.

5. Commendable Capital Expenditure Returns – In the past, H&R Block has been able to successfully provide positive outcomes on the capital expenditures it has invested in a variety of initiatives. H&R Block has a solid track record of completing new projects, and through creating new revenue sources, it has produced good returns on capital investments.

6. Effective Distribution Network – In order to cover the majority of its potential market, H&R Block has developed a solid distribution network throughout time. With several locations in practically every state and a robust distribution network behind them, H&R Block ensures that its services are quickly and easily accessible to a sizable number of clients.

7. Strong Social Media Presence – On the three most popular social media platforms—Facebook, Twitter, and Instagram—H&R Block has more than millions of followers, demonstrating its significant online presence. On these platforms, there is a lot of customer interaction and a quick reaction rate.

8. Extensive Product Portfolio – H&R Block offers items across a wide range of sectors in its expansive product line. It provides a variety of distinctive products that its rivals do not. H&R Block has dabbled in a number of industries other than services over the years. As a result, the business has been able to diversify its revenue sources beyond the services industry and the personal services sector.

9. Partnerships and Integration – Successful mergers and acquisitions by H&R Block have allowed it to combine complementary businesses. It has effectively merged a number of technology firms in recent years to streamline operations and create a trustworthy supply chain. H&R Block forms strategic alliances with its vendors, partners, retailers, and other interested parties. In the future, if necessary, it can use this to its advantage.

10. Leading Position in the Market – In the personal services sector, H&R Block holds a commanding market share. It has aided the business in quickly scaling up the successes of new services. Customers still enjoy the solutions they provide because they have remained of high quality throughout time and they believe they get good value for their money.

Weaknesses

1. Elevated Day Sales Inventory – Since it takes longer than typical for businesses to buy and sell things, H&R Block accumulates inventory, which adds needless expenses to the company’s operations. H&R Block’s long-term growth is impacted as a result of the company having to raise more money to invest in the channel.

2. Research and Development – H&R Block has to invest additional funds in technology to unify the operations across the board given the scope of the expansion and the various regions the business plans to expand into. The company’s vision currently does not match the level of technology investment. H&R Block spends more on research and development than the industry average, but far less than a few competitors who have benefited greatly from their cutting-edge innovations.

The old-school way of preparing taxes.

3. High Rate Of Staff Attrition – H&R Block has a greater turnover rate than other businesses in the sector, and therefore must spend far more money on employee development and training than its rivals. Given that there are fewer employees than the amount of work that needs to be done, the burden is high per employee. Employees are likely to be less efficient as a result of the mental stress this causes.

4. Outdated Organizational Structure – The only business model that is consistent with H&R Block’s organizational structure is the current one, which prevents the company from expanding into related product sectors. Since decision-making is heavily centralized, teams must get approval from certain officials for their decisions. Due to the increased time required, this lowers operational efficiency. Restricted development is another result of this weakness.

5. Reduced Current Ratio – Financial planning is not carried out effectively or correctly. The corporation can spend the cash more effectively than it is currently doing, according to the current asset ratio and liquid asset ratios. The company has a lower current ratio than the industry average, which indicates its capacity to satisfy short-term financial obligations. This could imply that the business may experience future liquidity issues.

Opportunities

1. Increased Consumer Spending – In the wake of the recession, both consumer expenditure and the average household income have increased. As a result, H&R Block’s target market will expand as more potential customers are drawn to the company. H&R Block may find new markets as a result of emerging trends in consumer behavior. The company has a fantastic opportunity to develop new revenue sources and diversify into other product categories as a result.

2. Emergence of E-Commerce – The e-commerce sector’s sales have increased and a new trend has emerged. This indicates that many customers are now doing online purchases. By establishing online storefronts and generating sales through them, H R Block can bring in revenue. The business has put a sizable amount of capital into the digital platform over the last few years. With this investment, H&R Block now has access to new sales channels. By getting to know its customers better and meeting their demands with big data analytics, the organization can take advantage of this potential in the coming years.

3. Lower Inflation Rate – Over the next two years, it’s anticipated that the low inflation rate will persist. Given that its input costs would stay low for the following two years, H&R Block has an opportunity. The market is more stable due to low inflation, which also allows H&R Block consumers to obtain loans at cheaper interest rates. Increased consumption of H&R Block items may also result from lower inflation rates.

4. Relaxed Trade Agreement – H&R Block now has the opportunity to access a brand-new, emerging market thanks to the adoption of new technological standards and government free trade agreements. Trade restrictions on the import of commodities have been lowered. The price of production inputs will go down as a result.

You Might Like: Is Great Clips a Good Franchise to Own? (+ Total Cost to Open)

5. Advancements In Technology – There are various advantages to technology across many departments. Automation of processes can lower operating expenses. Improved customer data collection and marketing operations are made possible by technology. The development of technology may also present H&R Block with a chance to implement a differentiated pricing approach in the emerging market. It will make it possible for the business to attract new clients with additional value-focused offers while retaining its existing clientele with excellent service.

6. Lower Tax Rate – The new tax laws may have a significant effect on how businesses are conducted and may present new opportunities for established firms like H&R Block to improve their profitability. H&R Block will benefit from the government’s lower tax rate since there will be a smaller tax expense.

Threats

1. American Isolationism – The growing trend of economic isolationism in the United States may cause other governments to respond similarly, which would hurt international trade. Plans for H&R Block’s expansion could be hampered by the strained trade relations between the US and China. A full-scale trade war may hamper the possibility for H&R Block to develop operations in China as a result of this.

2. Skilled Workforce Shortage – The lack of experienced workers in some international markets threatens H&R Block’s ability to maintain sustainable earnings growth in such markets. In addition, H&R Block may soon encounter issues with its human resources due to the high staff turnover and growing reliance on creative solutions.

3. High Fuel Prices – Sourcing expenses for H&R Block have gone up due to the increase in fuel prices. These expenses have grown as a result of rising fuel prices that have also affected other industries that this business relies on for resources, which has led to higher prices.

4. Stiff Competition – Prices are being pushed down as a result of increased industry rivalry. If H&R Block doesn’t respond to the pricing increases, it may lose market share. If it does, it could result in less income. Since there are now more competitors in the market due to stable profitability, both profitability and overall sales have been under pressure.

5. Demographic Shifts – In light of the baby boomers’ impending retirement, the younger generation is struggling to match their purchasing power. As a result of the younger generations’ lower brand loyalty and greater openness to trying new things, H&R Block may experience an increase in short-term earnings at the expense of a longer-term margin reduction. Due to shifting consumer preferences, businesses are under pressure to adapt their offerings on a regular basis to satisfy these consumers.

Is the H&R Block Worth the Cost to Invest?

Save money with professional tax preparation.

Is it worthwhile to invest in an H&R Block franchise? The answer will determine on your interests, experience, and personal finances. Here are some probing questions to ask yourself and uncover if it’s the right path for you.

- Do you have relevant work or business experience running a tax and accounting firm?

- Do you enjoy doing taxes for small businesses and individuals?

- Do you have connections or other in-roads with small businesses that you could contact to be clients?

- Do you have experience with local marketing?

The tax industry is in transition due in large part to automation through software. With that being said there is still a lot of opportunity to work with small, medium and large businesses. The bigger the business and more employees adds complexity and makes it more difficult to automate the tax filing process through software.

A Brief History of H&R Block

H&R Block, Inc., also known as H&R Block, is an American tax preparation business that has operations in Canada, Australia, and the United States, and. Henry W. Bloch and his brother Richard launched the business way back in 1955.

Henry W. Bloch sought to launch a family business in Kansas City during World War II alongside his brothers. Henry was inspired by a brochure he saw in 1946 that predicted a better future for businesses that assist small firms. In that same year, Henry and his elder brother Leon took out a $5,000 loan to start a modest bookkeeping firm on Main Street in the heart of Kansas City. Four months later, though, they struggled to find clients, and Leon made the decision to enroll in law school.

You Might Like: Is Westin Hotels & Resorts Franchise Worth the Cost to Invest?

Henry published an additional assistance ad in the local paper in order to continue his unsuccessful venture. His mom, who had unexpectedly responded, suggested that Henry employ his younger brother, Richard, for the position. Together, Henry and Richard Bloch managed their accounting, bookkeeping, and payroll-focused company. In 1955, the brothers placed an advertisement in The Kansas City Star advertising their $5 tax services, the rest was history.

Who Owns H&R Block?

By controlling 92.16% of the outstanding shares of HRB, institutional investors own a majority stake in the company. Additionally, this interest is higher than it is at practically any other business in the Other Consumer Services sector. During the quarter that ended in April 2019, these big investors bought shares for a net $2.3 million.

Leading these institutional investors is The Vanguard Group, Inc. with 19,375,174 shares owned, or a 12.11% stake in the company. They are followed by BlackRock Fund Advisors with 10.66%, Jupiter Asset Management Ltd. with 5.75%, SSgA Funds Management, Inc. with 4.79%, and Fidelity Management & Research Co. with 4.71% among a broad list of investors.

Is H&R Block affiliated with the IRS?

The simplest answer to this question is a no. First and foremost, the IRS is the government’s federal agency tasked to supervise tax collection as well as the implementation of tax laws. H&R Block meanwhile is a privately-owned listed auditing firm offering tax preparation services to taxable individuals and businesses.

However, H&R Block processes tax preparation for their clients in order for them to have a seamless transaction with the IRS instead of them directly doing it themselves. In a sense, they work hand in hand, H&R Block facilitating tax returns to the IRS.