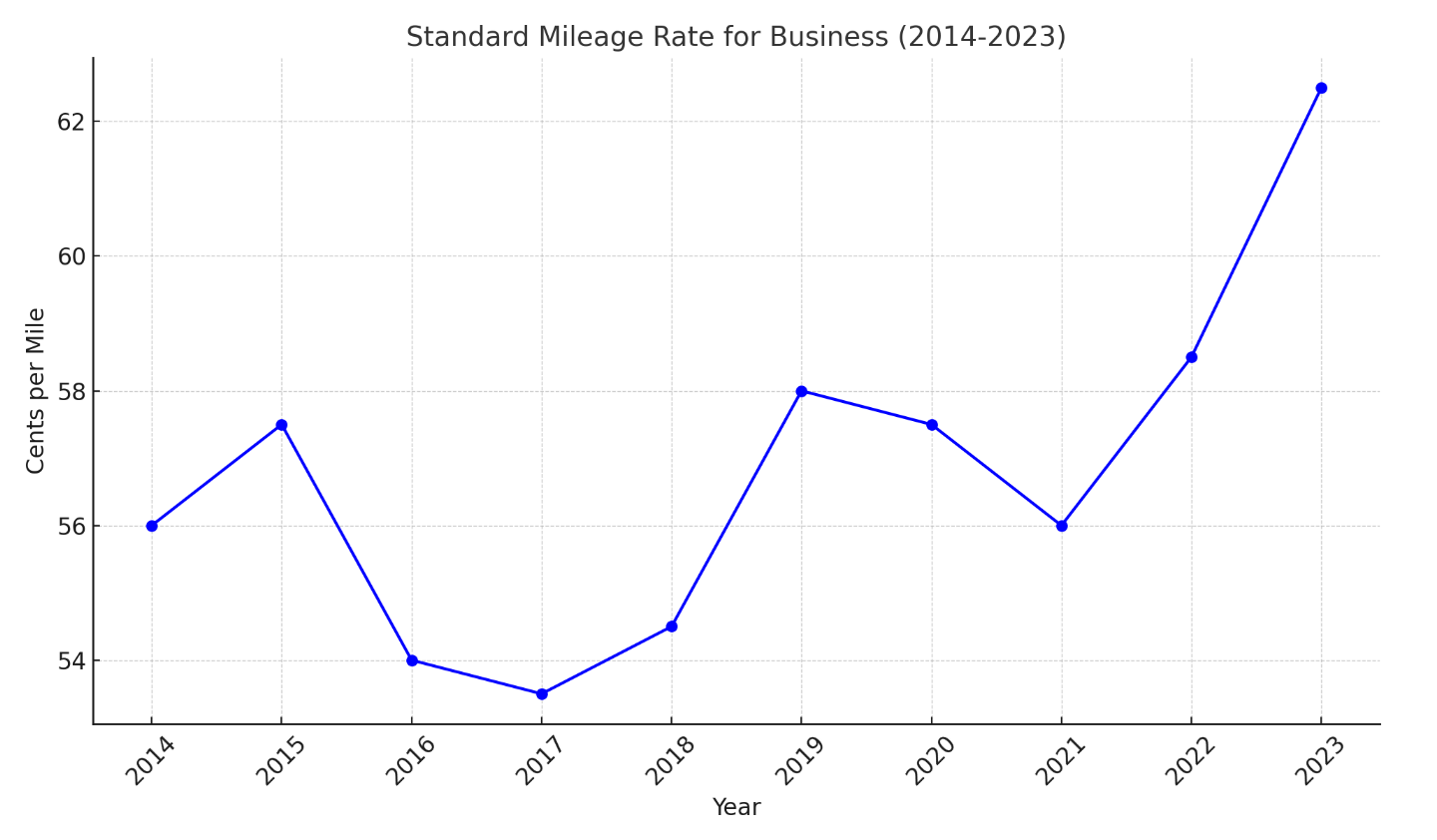

The Internal Revenue Service (IRS) has announced the standard mileage rates for 2023, pivotal for food truck owners and operators to calculate the deductible costs of running their mobile culinary ventures. Effective from January 1, 2023, these rates are essential for managing the expenses associated with vehicle use in the food truck industry. Here are the standard mileage rates for business in 2023.

- 62.5 cents per mile for business miles driven, an adjustment reflecting changes in the cost of operating a vehicle.

- 14 cents per mile driven in service of charitable organizations, consistent with prior years, as this rate is set by statute.

The increase in the business mileage rate from previous years underscores the IRS’s acknowledgment of the higher costs associated with vehicle operation, including fuel, maintenance, and depreciation. These changes are vital for food truck operators to note as meticulous mileage tracking can lead to significant tax deductions. This is great news if you’re preparing your food truck taxes for 2023.

It is important to highlight that, following the Tax Cuts and Jobs Act, certain deductions have been modified. For instance, miscellaneous itemized deductions for unreimbursed employee travel expenses are no longer permissible, and deductions for moving expenses are largely eliminated, except for active-duty military members under specific circumstances.

2023 Fuel Price Insights

In 2023, the price of gasoline in the United States experienced changes but ended on a more stable note. On average, people paid $3.52 for a gallon of gas. The highest price during the year was $3.88 per gallon in mid-September, which was much lower compared to the high of $5.01 per gallon in June 2022. By the end of 2023, gas prices had decreased to $3.05 per gallon.