Since rolling out their LLC service in 2004, IncFile has helped more than 500,000 business owners start their company. While there are many options when forming an LLC, this company has become one of the top providers in the DIY legal space.

In this review, you’ll know the pros and cons of this LLC service. We’ll also talk about pricing, reviews, and the top alternatives, so you can select the right option depending on your needs. In short, while IncFile is low-cost if you’d like some hand-holding or to form an LLC, there are better options to explore. Let’s dig into the details below. My top pick for LLC formation is ZenBusiness where you can get started for $39 + State Fees.

- Price: 8 out of 10

- Customer Support & Refund Policy: 3 out of 10

- Customer Reviews / Reputation: 4 out of 10

- Ease of Use / Customer Experience: 9 out of 10

- Total Score: 24 out of 40 (Average Score)

Page Contents

- Advantages of IncFile LLC Service

- Disadvantages of IncFile LLC Service

- How Much Does It Cost to File an LLC With Fees?

- Silver

- Gold

- Platinum

- Customer Support + Refund Policy

- Customer Reviews and Reputation

- Ease of Use / Customer Experience

- Total Score: 24 out of 40

- IncFile LLC Service Alternatives

- Northwest Registered Agent

- Swyft Filings

- Rocket Lawyer

- Frequently Asked Questions

- Is IncFile Free?

- Do you need to pay for an LLC every year?

- Is there a refund policy?

- What upsells are there with this service?

- Do you need the upsells?

- Can you form an LLC on your own?

- How long will it take to process an LLC formation?

- Do you need an LLC?

- Is my information shared with third parties?

- How are you taxed with an LLC?

Advantages of IncFile LLC Service

- More than 80% of new small businesses form as an LLC. This is a straight-forward business structure with privacy, tax, and liability benefits.

- IncFile’s website does a great job in helping you figure out how to start and structure your business. Each of their product pages features detailed info, including pros and cons, legal requirements, and more. They even have a full learning center, state-specific info, and downloadable guides available.

- You will only pay the state fee with their basic plan. With that, you’ll get your articles of organization prepared and filed plus unlimited name searches and one year of free registered agent services. Other services, like LegalZoom, tend to charge at least $99 plus state filing fees for their basic package.

- When it comes time to renew your LLC with the state each year, IncFile will send out an email and text notification. That way, you won’t have to worry about missing that date and having to pay late fees.

- With all their packages, you get one year of registered agent services free. This allows their team to fill out and process business paperwork on your behalf, no extra steps needed.

Disadvantages of IncFile LLC Service

- You do not get unlimited customer support, an EIN business number, access to their online dashboard, expedited filing, or any extras unless you select their more expensive packages. So, if you get the basic plan, be prepared to wait and handle any extra business setup steps on your own. They do offer upsells like the operating agreement, banking resolution, and business contract templates for an extra charge.

- Since IncFile serves so many customers per year, there’s a chance of having a less-than-stellar experience. Many people complain of long wait times, poor customer service, and an inability to quickly and easily cancel their accounts.

How Much Does It Cost to File an LLC With Fees?

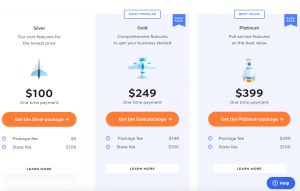

In addition to the state filing fee, you will pay anywhere from $0 to $499 for IncFile’s LLC services. You have three plans to choose from, each of which build upon the prior level of service. You can browse through the exact services in each package for yourself on their website. But here’s a brief look into the most important services offered.

Silver

Price: $0 + State Fee

A truly affordable LLC service option that includes:

- Articles of Organization: IncFile will write up all the paperwork needed to form your LLC. Then, they will submit the articles of organization to the official business office for your state.

- Name Searches: As you come up with names, they will search the database in your state to make sure they aren’t taken. There’s no limit to how many names they will search for.

- Registered Agent Service: For one year, IncFile will serve as your registered agent and accept all vital documents for your company. After they receive each item, they will send the documents over for your review.

Gold

Price: $349 + State Fee

A middle-of-the-road plan that features all the services included in the Silver plan along with:

- EIN: They will file for your employer identification number for you after forming your LLC. With this number, you can move forward in hiring employees, opening a bank account, and filing taxes.

- IRS Form 2553: Upon filing this tax form on your behalf, IncFile opens the doors for your LLC to be treated like a corporation when it comes time to file. You can then potentially save money on taxes each year.

- Operating Agreement: The IncFile team will draft a thorough operating agreement for your company. This custom document spells out how your company will operate in the first year and beyond.

- Banking Resolution: With this plan, you will receive a banking resolution, which gives you the right to open a bank account for your LLC. Your EIN can work, too, but this document helps if you run into any problems along the way.

- Lifetime Alerts: The lifetime alerts ensure you get notified when it comes time to pay your annual fee, renew your business license, or complete any other important steps.

- Unlimited Support: Only at this level and beyond do you get unlimited support by phone and email. You can send them your questions and concerns as needed to best navigate the platform and set up your LLC.

- Online Dashboard: The online dashboard lets you see the status of your business, review any alerts, and access all your documents.

Platinum

Price: $499 + State Fee

A full-service option that includes all the services in the prior plans plus:

- Business Contracts: With this level of service, you get access to more than 30 legally binding contract templates that you can use to protect the status and integrity of your LLC.

- Expedited Filing: With expedited filing, you can skip the long wait and breeze through the formation of your LLC in about a week. Otherwise, you can expect it to take up to five weeks.

- Website Name and Email: IncFile will give you a branded domain name and email address through their partner, SnapWeb. The website will feature a basic design created by their team. You can expect to pay $20 per month for hosting on top of the IncFile package fee.

Our Rating on Price: 8 out of 10

Customer Support + Refund Policy

The customer support at IncFile is virtually non-existent even when you sign up for their Gold and Platinum plans. Although those service levels boast unlimited phone and email support, it often takes quite a fight to get a clear resolution for your concerns based on the online reviews.

If you just have a basic question about how to use their site, then you might have better luck. But if you have their Silver plan or haven’t signed up yet, then don’t expect timely service.

The refund policy is equally dismal since it simply does not exist. They do not advertise any guarantees on their website, leaving you guessing about how they resolve disputes about service quality.

You can request a refund, but they will not honor it if they already sent your paperwork to your state’s business office. Beyond that, they have a $30 cancellation fee and make it quite difficult to remove your payment information from their system.

Bottom line, make sure to file your LLC correctly the first time. If you’re someone that needs some hand-holding or live support an alternative LLC service is the best choice for you.

Customer Support Score: 3 out of 10

Customer Reviews and Reputation

While IncFile does have more than their fair share of positive reviews, there are plenty of unsatisfied customers too. On Reddit, prior customers are adamant about skipping the hassle and handling LLC filing yourself. Twitter is equally full of dissatisfied individuals who wished they had gone another route.

Worse yet, the Better Business Bureau recently revoked IncFile’s accreditation due to their failure to abide by their standards. Although the exact reason for the revocation is unclear, past customers have left over 240 complaints in the last three years.

On Trustpilot, IncFile has 2.8 stars out of 5. Their positive reviews applaud their ability to make the process much easier and more approachable. Many reviewers are also happy that their service plans are so affordable and provide excellent value.

On the negative side, many people are unhappy that the process can take so long, especially when issues occur along the way. They are also dissatisfied with the customer service quality and ability of the support team to thorough resolve concerns that come up.

Reputation Score: 4 out of 10

Ease of Use / Customer Experience

Here’s what the step-by-step process is like to file an LLC with IncFile. To start filing process click on the “Form Your LLC Now” button as shown below.

Next, you’ll be taken through a LLC creation wizard that asking two questions: 1.) the business entity you would like to form (LLC) 2.) The state you plan to operate the business.

Next, you’ll be taken through a LLC creation wizard that asking two questions: 1.) the business entity you would like to form (LLC) 2.) The state you plan to operate the business.

Then you’ll have the choice of choosing a Silver, Gold, or Platinum formation option. What you get with each of these options is outlined in the cost section here. I chose the Gold option for my LLC.

Choose from silver, gold, or platinum LLC formation options.

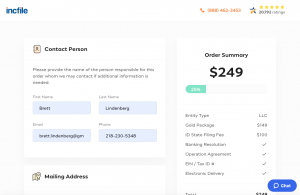

Next, you’ll be directed to enter the contact information for the person completing this form (probably you) along with the address you’ll like the LLC documents mailed. This does not need to be the same address as your business.

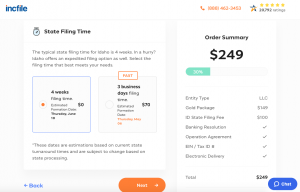

Next choose how fast you would like to receive your LLC formation documents. Anticipated wait times will vary from state to state. If you’re in a hurry you can select a faster filing time for an additional fee as shown below.

Select the state filing time.

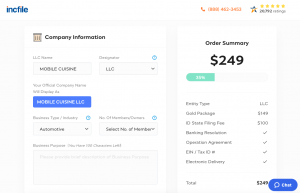

Make sure you have the following information ready to enter on the next page: LLC Name, Designator (LLC, L.L.C., LIMITED COMPANY, LIMITED LIABILITY COMPANY), select the Business Type / Industry, Number of Members / Owners, and write a brief business purpose. Next add the company address. This cannot be a P.O. box.

Enter your company information.

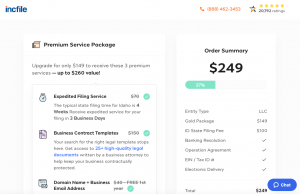

After that you’ll be asked if you would like to upgrade to the premium service package for $149. This includes a domain name, business contract templates, and an expedited filing service. I chose to pass on this particular opportunity.

Premium service package offer.

The next step will ask you to select if the member is a person or a company. If you have multiple members in your company this is also where you will designate who owns what % of the business. I own 100% of my business.

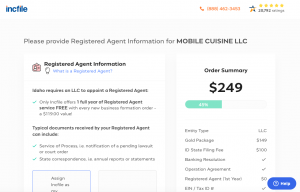

Next, you’ll provide a registered agents contact information. A registered agent is the person that will be contacted in the event the business is sent a legal notice, court order or other message from the government.

When you use IncFile to form your LLC, you get a free year of the companies registered agent service. You’ll be charged $119 annually to continue using this service. In my opinion, it’s a no brainer to enroll in this service. You don’t want to be in charge of this obligation yourself when you could meet this requirement for less than $10 per month.

Assign a registered agent.

The next form will create an EIN / tax identification number for your business. This is the number the IRS uses to identify a tax payer. Enter your name, social security number, physical street address of the business, and principal business activity from the list of options (insurance, retail, manufacturing, etc.).

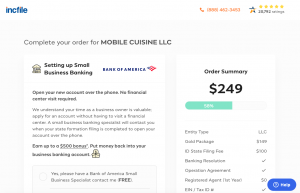

As with other LLC formation services, you’ll be asked if you need to setup a bank account with Bank of America and have an option to schedule a call with an advisor at no additional cost. I already have a business bank account setup so I selected “no” for this option.

Bank of America option.

Next, you’ll be offered a tax strategy consultation. It doesn’t take a genius to figure out you’re scheduling a sales call with a tax / accounting firm of some type. I stated that I was not interested in this time and clicked the next button.

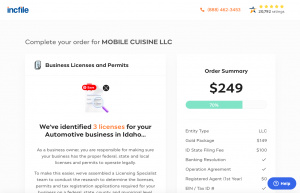

Some businesses require special licenses beyond a general business license to operate. A dentist or doctor office are two examples of businesses that will require additional licenses to operate legally. If you aren’t sure what you need, I think this is a good option to save you time researching the specific licenses you’ll need to operate in the state for an additional charge of $99.

Business license and permits.

Next, you’ll review your order to make sure everything you’ve submitted is correct. Make sure to double check spelling closely because getting this information changed can be a major pain. If everything looks good then click the next button.

The last step is to enter your credit card / debit information and complete payment. The entire process took me 25 minutes to complete.

Ease of Use: 9 out of 10

IncFile breaks down the LLC formation process into bite sized steps. The checkout process also includes numerous helpful tabs that explain legalese in plain English.

Like other formation companies there are upsells, but the benefits are more clear than competitor websites.

Total Score: 24 out of 40

IncFile gets a mixed score. The checkout process and cost of the service is fantastic and gets extremely high marks. But if problems arise requiring a human or you need some support, based on the online reviews expect a headache.

Bottom line, if you’re experienced with completing an LLC formation you should be fine. This is a reputable company that’s helped more than half a million businesses get their start at an affordable price. But if you aren’t confident about your ability to accurately complete the LLC information or want a more personalized touch, review the alternative options below.

IncFile LLC Service Alternatives

If IncFile LLC Service does not seem to live up to your expectations, you have many other options to consider, such as:

Northwest Registered Agent

Northwest Registered Agent has been helping business owners create their LLCs since 1998. They have a positive reputation in the industry and take a no-nonsense approach to all they do. We gave Northwest Registered Agent a review of 34 out of 40, which is an extremely strong score.

The main reason for the high-marks is the customer support is second to none and they resolve questions and concerns fast. IncFile isn’t known for this level of support.

Northwest Registered Agent only has one service plan, however. If you want anything else beyond their basic offerings, you’ll have to pile on the add-ons, which can greatly increase the total price of filing an LLC.

Swyft Filings

Created in 2012, Swyft Filings aims to make it easy to create your LLC. We gave Swyft Filings a strong score of 30 out of 40.

Swyft Filings has three price plans, starting at $49 but none come with registered agent service. If you want that service, you will need to pay $149 per year on top of their package price and state filing fee. They do offer a 100% money-back guarantee and great customer support, which earns them lots of positive reviews.

Rocket Lawyer

When Rocket Lawyer was founded in 2008, they instantly became the go-to place for legal documents and assistance with business matters. Their LLC service is a popular choice with those who want to quickly submit their info and let someone else deal with the details.

Despite their high customer volume, their reviews were initially on the negative side, so they’ve had to work their way back from that. In addition, they are one of the more expensive options and do not offer as many standard services, like registered agent service. We handed Rocket Lawyer an evaluation of 33 out of 40 during our most recent review.

Frequently Asked Questions

Is IncFile Free?

Not exactly. While it’s true that IncFile does not charge anything for their basic plan, you still have to pay the state filing fee. Most states charge between $75 and $300 to file for an LLC with the Secretary of State or other business office.

IncFile does have a package fee of $149 to $299 for their Gold and Platinum plans, respectively.

Do you need to pay for an LLC every year?

Yes, most states charge an annual fee to keep your LLC active and in compliance with local laws. In a few states, like Alaska, Indiana, and Iowa, you only need to pay a biennial fee.

Other states may have you fill out an annual information report instead, such as Idaho, Minnesota, and Mississippi. Either way, the fee ranges from $10 in Colorado to $820 in California. States without a filing fee include Arizona, Missouri, and New Mexico.

Is there a refund policy?

IncFile does not have a refund policy on the books. You can file a complaint if you have a bad experience, although there’s no guarantee on how they will handle it. In some cases, they might give your money back, but it is largely up to the discretion of the customer service rep.

What upsells are there with this service?

There are many upsell options offered when you select the Silver package. You can pay extra to get an employer identification number, operating agreement, banking resolution, and business contract templates.

If you don’t want to wait the standard filing time for your state, you can sign up for expedited service that cuts the time by 1/3 or more.

Do you need the upsells?

The way you will operate your business greatly influences whether you need the upsells from IncFile. If you will pay employees, you must get their EIN upsell or navigate the process on your own.

Other tasks you’ll have to navigate on your own if you skip the upsells include opening a business bank account, creating an operating agreement, and writing up contracts for your company.

Can you form an LLC on your own?

In every state, you do have the option to form an LLC on your own. You will need to select your business name and a registered agent, prepare your paperwork, and file your articles of organization. In order to avoid delays or other issues, you must learn your state laws and process for forming an LLC before getting started.

How long will it take to process an LLC formation?

In most states, it can take anywhere from three to five weeks to process your LLC paperwork. With the expedited option from IncFile, you can have your paperwork processed in as little as five days.

Do you need an LLC?

If you want to eliminate personal liability for business debts then you need an LLC. This business structure is also beneficial if you plan to hire employees or just want your business to have an identity separate from yours.

Yes, in order to complete and process your LLC paperwork, IncFile does share your information with third-party vendors. As detailed in their privacy policy, by inputting your information into their website or using their services, you confirm your consent for them to store, use, and share the data.

How are you taxed with an LLC?

While running an LLC, you will follow the same tax rules as a sole proprietorship. The business itself will not have taxes to file. Instead, you will file all business income as your own and pay taxes on it as indicated.